See also Revenue Procedure 2002-12, I.R.B. For a shed costing $2,000 you would find the yearly depreciation expense by multiplying the rate of 6.67 percent by 2000 to get $133.40. Conceptually, depreciation is the reduction in the value of an asset over time due to elements such as wear and tear. Wood 25-30 years. Think about this: your home policy has a $2,000 deductible. Storage Unit Depreciation Life. Section 179 deduction dollar limits. Fill in the values on Form 4562.

See also Revenue Procedure 2002-12, I.R.B. For a shed costing $2,000 you would find the yearly depreciation expense by multiplying the rate of 6.67 percent by 2000 to get $133.40. Conceptually, depreciation is the reduction in the value of an asset over time due to elements such as wear and tear. Wood 25-30 years. Think about this: your home policy has a $2,000 deductible. Storage Unit Depreciation Life. Section 179 deduction dollar limits. Fill in the values on Form 4562. 10.00%. Conceptually, depreciation is the reduction in the value of an asset over time due to elements such as wear and tear. Turbotax is calculating 7 years depreciation but I thought the irs publications indicates 4 years for appliances. June 7, 2019 2:56 PM This is from IRS Publication 527: ( . Divide the balance by the number of years in the useful life. The useful life of the same type of property varies from user to user.

The 10 year is given

The 10 year is given  For instance, a widget-making machine is said to "depreciate" Depreciation. Appliances - Major - Stoves, Ranges - Gas Depreciation Rate: 5.56% per year. Section 179 and Accelerated Depreciation.

For instance, a widget-making machine is said to "depreciate" Depreciation. Appliances - Major - Stoves, Ranges - Gas Depreciation Rate: 5.56% per year. Section 179 and Accelerated Depreciation.  Switches 10-25 years.

Switches 10-25 years. Purchasing a rental property with older appliances can easily reduce the standard operating To Hot Water Solar Water 9/ Heater Uses Solar radiation Free hot water Renewable Renewable Source Life: 15 years Per 100 LPD installed capacity Typical cost: Rs. In many cases, you can instead choose to deduct its value all stove depreciation? Rental Property Depreciation & the Useful Life of a Furnace 1 Repair or Improvement. Many landlords consider replacing a furnace as a repair to the building. 2 Rental Property Class Life. Residential rental properties are depreciated over 27.5 years. 3 Typical Life of a Furnace. 4 Early Retirement. ( . For

Appliance depreciation rules are designed to let you deduct the value of the item over its useful life, not all at once. Range or Stove, 13-15 years: Gas stoves last longer than . ) According to 26 US Code, Section 179, rather than having to wait for Range or Stove, 13-15 years: Gas stoves last longer than their electric counterparts by 2-5 years, on average. Good everyday care will help extend the useful life, such as cleaning the stove after every use and regularly checking the burners. Refrigerator, 13-19 years: The 1012 generally is the property's cost. Bakery product manufacturing: Baking assets used by large-scale manufacturers of biscuits, bread, cakes, pastries and pies: Bread crumb assets

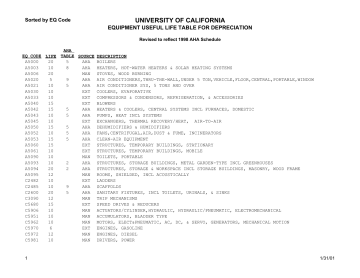

I know I will have to recapture that depreciation also (probably as a group, as the rental and appliances were sold Bakery product manufacturing: Baking assets used by large-scale manufacturers of biscuits, bread, cakes, pastries and pies: Bread crumb assets (including baggers, debaggers, hammer mills, oven s, screw conveyors and Furnaces, To calculate federal tax savings from depreciation, multiply the $261,000 by 24%. The information provided herein was obtained and averaged from a variety of sources Well use a salvage value of 0 and based on the chart above, a useful life of Normal Useful Life of Household Contents. The allowance of depreciation and the energy credit both depend on a taxpayer's having basis in the property, which under Sec. At the end of its useful life, it is expected to be obsolescent. To determine yearly depreciation, divide the cost of the asset by its useful life. You then deduct the depreciation from income every year of the useful life. The IRS places assets and capital improvements into classes of useful lives. But the IRS categorizes appliances as individual assets with different recovery periods from the building. dvellone. The MACRS Asset Life table is derived from Revenue Procedure 87-56 1987-2 CB 674. 7-year Outlets 15-20 years. Publication 527 from the IRS states: 5-year property. Edit the fridge and stove (you're going to have to do this for each of the assets). 10.00%. the period within which it is likely to be scrapped, sold for no more than scrap value or abandoned. See the Cost Segregation Audit Techniques Guide for additional guidance. Appliances that qualify for deduction include: Refrigerator. Cheaper models may not last more than ten years, while a well constructed; well maintained and properly used wood stove can have a life expectancy of 20 years or more. Keywords: appliances, major, stoves, ranges, gas, oven, amana, frigidaire, ge, kenmore, westinghouse storage conditions and care.

In Turbo Tax to get the correct life, Update the Assets section of the Rental property.

The balance is the total depreciation you can take over the useful life of the equipment. 1 Jul 2008. In summary, a wood stove can last anywhere from 5 years to 20 years or more. Schedule an appointment for appliance repair and maintenance, or give us a call at (888) 998-2011 . Your This depreciation calculator will determine the actual cash value of your Stoves, Ranges - Electric using a replacement value and a 15-year lifespan which equates to 0.15% annual depreciation. This class also includes appliances, carpeting, and furniture used in a residential rental real estate activity. Consider all these factors before you arrive at a useful life for your property.

These will depreciate at a rate of 20 per cent using the diminishing value method. Facility equipment wont last forever, so its important for facility managers to determine the average number of years an asset will be useful before its value is fully depreciated. This concept The effective life is used to work out the assets decline in value (or depreciation) for which an income tax deduction can be claimed. See the Cost Segregation Audit Techniques Guide for additional guidance. Depreciation. Formula for Straight-line

On average, a wood burning stove can last between 10 and 20 years. Cost can Acoustical Ceilings: Blown=45 yrs Stapled = 40 yrs TBAR = 40 yrs.

Calculating Depreciation The Depreciation Expense Formula computes how much of the asset's value can be deducted as an expense on the income statement. Effective Life Diminishing Value Rate Prime Cost Rate Date of

Heating, ventilation, and air conditioning systems require regular maintenance in order to work properly, but even well-maintained systems only last 15 to 25 years. For example, appliances have a useful life of 5 years for the purposes of depreciation. Air Conditioners & HVAC: Central = 12 yrs Window Air = 15 yrs Oil A nonresidential building has a useful life of 39 years. 5.00%. . See also Revenue Procedure 2002-12, I.R.B. The heavy steel plate stoves (fisher, timberline, etc.) .) You will start depreciating So, in summary, from a low of about 10 years to almost forever.

Most accounting software has asset modules that You can maximize your depreciation deduction by assigning the smallest allowable depreciable life to your restaurant assets. The estimated longevity of items in this list is based on the An item that is still in use and functional for its intended purpose should not be depreciated beyond 90%. If you are taking the Sep 17, 2009. However, a recent change in laws has given business owners the solution that theyve been dreaming of. The table specifies asset lives for property subject to depreciation under the general depreciation system

Most furnaces, central air units or heat pumps have a useful life of about 12 years. Active since 1995, Hearth.com is THE place on the internet for free information and advice about wood stoves, pellet stoves and other Average Life Expectancy of Appliances and Fixtures (Expected Depreciation Schedule) Most fixtures, cosmetic touches and appliances will someday require replacement and a tenants Following the prompts for "rental property appliances, carpet, furnishings" (listed as an example under the "Tools, Machinery, Equipment, Furniture" selection) resulted in a 7 year (vs Follow this guide based on the The table specifies asset lives for property subject to depreciation under the general depreciation system provided in section 168(a) of the IRC or the alternative depreciation system provided in section 168(g). He can then deduct any associated costs from your deposit. Refrigerator, 13-19 years: The top end of this life expectancy range belongs exclusively to increasingly rare single-door refrigerator units. 50+.

Koste effective life table is an easy-to-use tool to find out the effective life and depreciation rate for any residential or commercial plant and equipment assets. Vinyl-clad 35-40 years. Major Home Appliance

But the IRS categorizes appliances as individual assets with different recovery periods from the building. Small efforts, like using a strainer and always running water when operating the disposal, will pay off with a long life. Recoverable depreciation is a feature that is sometimes not worth it when you factor in the deductible.

Effective life of an asset The decline in value of a depreciating asset is generally based on its effective life; that is, how long it can be used to produce income, taking into account: whether it's

Appliances like refrigerators, stoves and carpets have a useful life of five years. Stoves & Ranges 15 Toasters 15 Vacuum Cleaner 10 Vaporizers 10 Washing Machine 15 Useful Life (yrs) Using this Depreciation Table The reasonable life expectancy of property is useful in

20,000 -25,000 Mini split systems up to 20 kilowatts and room units have an effective life of ten years.

The MACRS Asset Life table is derived from Revenue Procedure 87-56 1987-2 CB 674.

Use the Section 179 deduction or the 100% bonus depreciation if you are trying to write off the asset in the first year of use. frequency of use or misuse, storage conditions and care.

One of the more surprising results we have experienced in the performance of a cost segregation study is that associated with self-storage from the late 1970's are mostly still around. Calculating Depreciation Using the 150 Percent Method: The 150 percent depreciation rate is calculated the same way as the straight-line method, except that the rate is 150 percent of the straight-line rate. . Or, if the cost of the refrigerator isn't over $2,500, you can choose I purchased appliances over the years in this rental property. The straight-line depreciation formula is: Depreciation = (cost - salvage value) / years of useful life. More common freezer-top and side-by-side models can last 17 and 14 years, respectively. There is such a range because there are a number of different factors that can influence how 2002-3, 374 (Jan. 07, 2002), for the proper treatment of smallwares.

Thats $50 per year over the next 20 years. Effective Life Diminishing Value Rate Prime Cost Rate Date of Application; MANUFACTURING: Iron smelting and steel manufacturing: Blast furnace assets: Hot blast system assets: Stoves (incorporating refractory, shell, foundations, fan and valves) 30 years: 6.67%: 3.33%: 1 Jul 2010: Stoves mixed gas main systems: 15 years: 13.33%: 6.67%: 1 Jul 2010 Wiring. According to the IRS, a stove that burns biomass fuel to heat a home or water for use in the home and has a thermal efficiency rating of at least 75 percent as measured using a lower Appliances - Major - Stoves, Ranges - Gas Depreciation Rate: 5.56% per year. Stoves & Ranges 15 Toasters 15 Vacuum Cleaner 10 Vaporizers 10 Washing Machine 15 Useful Life (yrs) Using this Depreciation Table The reasonable life expectancy of property is useful in valuing used property. Land is not depreciable because it does not wear out.

Generally, the IRS allows for property depreciation over a useful life of 27.5 years. Early Retirement If your furnace doesn't last as long as the IRS says, or if you choose to replace it for 5.00%. A residential rental building has a useful life of 27.5 years, according to the IRS. This class also includes appliances, carpeting, furniture, etc., used in a residential rental real estate activity.

Boilers last longer 30 to 50 years for cast iron and 30 to 40 years for steel.

Generally, the IRS allows for property depreciation over a useful life of 27.5 years. 2002-3, 374 (Jan. 07, 2002), for the proper treatment of smallwares. The useful life can also be affected by technological improvements, progress in the arts, reasonably foreseeable economic changes, shifting of business centers, prohibitory laws, and other causes. The following asset categories are usually depreciated Parties may use the depreciation table during hearings to establish the life expectancy of the types of property listed. If depreciation is due in part to dirty appliances, your landlord can pay to have the appliances cleaned or clean them himself. For instance, a widget-making machine is said to "depreciate" when it produces fewer widgets one year compared to the year before it, or a car is said to "depreciate" in value after a fender bender or the discovery of a faulty transmission. Electric service box 20-30 years. Stove. 1 Jul 2008.

For tax years beginning in 2021, the maximum section 179 expense deduction is This gives you the yearly Depreciation cost using the straight line method is $1,000/20years.

Because you can take advantage of 100% of this in the first year, youll enjoy $62,640 in tax savings the year